Deciphering Bitcoin – Part 2: Why Bitcoin was created

Click here to read Part 1: The current system

Bitcoin is difficult. It's disguised as a scam, as a tool for criminals, as an environmental disaster. But the insights hit you bit by bit, until the pieces of the puzzle suddenly fall into place.

Today we're going to take our next step in the journey. We're gonna have a look at the reasons Bitcoin was actually created, both the reasons Satoshi Nakamoto mentioned and the ones we came to associate with it over the years.

Inflation as a hidden tax

In the last chapter, we discovered that inflation is a secret tax on society, mostly captured by banks and regulators.

Society gets more prosperous every year due to technical advances and productivity improvements. The banks discovered that they can siphon off a large part of these gains without too many complaints from the people.

They do this by increasing the money supply, loaning out freshly minted money and getting interest on that money.

But that's just the tip of the iceberg.

Holding society hostage

I have five houses... and a condo. – Florida strip club dancer, 2008

Here's a quick 2008 recap:

- Prices for homes and condos were skyrocketing and everyone was getting in on the action

- Many of these buyers couldn't afford the homes they were purchasing

- Banks gave out subprime mortgages: loans given to borrowers with sketchy credit histories and low incomes

- The banks knew these were risky, but they figured they could sell these loans to other investors before the borrowers defaulted

- They came up with a genius plan: bundle these risky mortgages into securities called CDOs, and sell them to unsuspecting investors

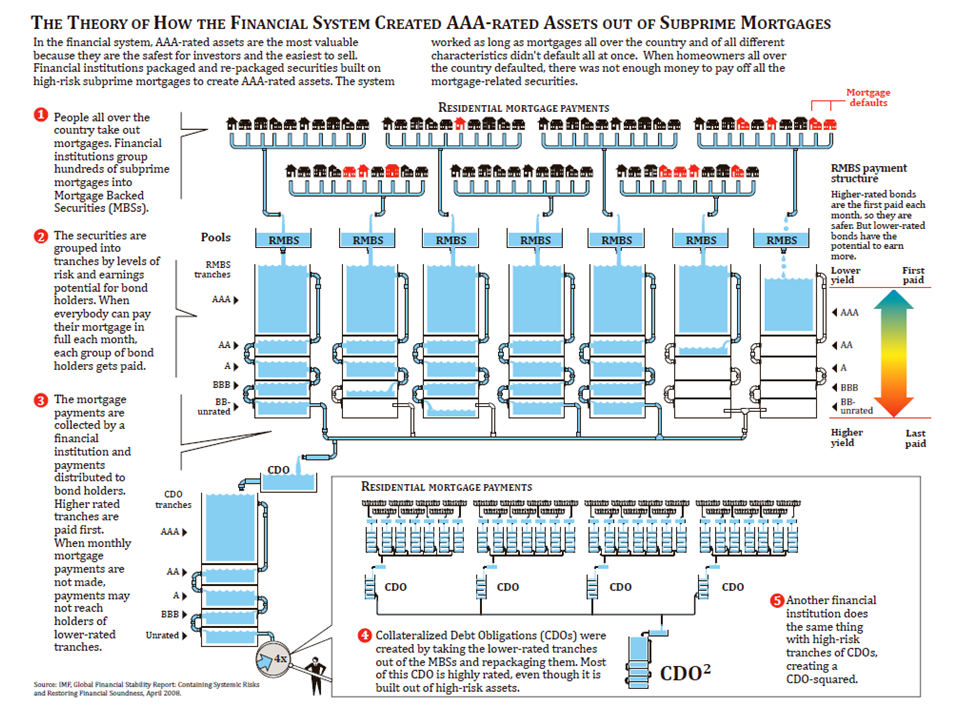

Here's a nice explanation of CDOs:

As you can see, the money (displayed as water) only flows to the CDOs if the lowest tranches also get paid (if the lowest buckets of the RMBS also get filled with water). The problem is that the CDOs were disguised and investors didn't know they were essentially buying the lowest tranches.

Another visualisation:

Basically, it's crap disguised as top notch stuff:

OK, I'm a chef on a Sunday afternoon, setting the menu at a big restaurant. I ordered my fish on Friday, which is the mortgage bond that Michael Burry shorted. But some of the fresh fish doesn't sell. I don't know why. Maybe it just came out halibut has the intelligence of a dolphin. So, what am I going to do? Throw all this unsold fish, which is the BBB level of the bond, in the garbage, and take the loss? No way. Being the crafty and morally onerous chef that I am, whatever crappy levels of the bond I don't sell, I throw into a seafood stew. See, it's not old fish. It's a whole new thing! And the best part is, they're eating 3-day-old halibut. *That* is a CDO.

No-one really noticed the crap, except for some very smart and lucky people.

But as more and more borrowers started defaulting on their loans, the value of these CDOs plummeted. Suddenly, the banks that had sold them were sitting on massive losses.

And it didn't stop there. The banks had also taken out massive amounts of debt in order to fund their risky mortgage bets. When the housing market collapsed, they couldn't pay it back.

One by one, the dominoes began to fall. Lehman Brothers, a giant investment bank, declared bankruptcy in September 2008. The U.S. government was forced to bail out other major banks, including AIG, Citigroup, and Bank of America.

In the years that followed, hundreds of bankers and rating-agency executives went to jail. The SEC was completely overhauled, and Congress had no choice but to break up the big banks and regulate the mortgage and derivative industries. Just kidding! Banks took the money the American people gave them, and used it to pay themselves huge bonuses, and lobby the Congress to kill big reform. And then they blamed immigrants and poor people, and this time even teachers! And when all was said and done, only one single banker went to jail this poor schmuck!

So this was the housing crisis of 2008. Not many lessons were learned.

When the dust settled from the collapse, 5 trillion dollars in pension money, real estate value, 401k, savings, and bonds had disappeared. 8 million people lost their jobs, 6 million lost their homes. And that was just in the USA.

How could this happen in the first place? Well...

We had blind faith in the regulators who were supposed to oversee the financial markets and take out bad actors.

We trusted the auditors.

We trusted the bankers to not be too greedy.

Above all, we let the government bail out the banks every time they did something bad.

Global crisis, trillions of dollars evaporated. The banks say "Well if you let us go bankrupt, the whole world will suffer". So the government says "Ok sure that makes sense, let's give you billions more so you don't go bankrupt".

What's the first lesson fresh parents learn? To be consistent. To punish your kids for bad behaviour and reward them for good behaviour.

If you reward your kids each time they fuck up, guess what they'll do next...

If you reward stupid behaviour, like taking insane risks, gambling it all for profit... then you'll get more of that behaviour.

We're essentially continuing a system where profits are privatized and... losses socialized. – Nouriel Roubini

Bailouts are the taxpayer paying out of pocket to reward the behaviour of gambling banks.

We don't know who created Bitcoin, but it's clear this was one of the main motivations behind the creation.

The message hidden in the Genesis block of Bitcoin read:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

And then Satoshi Nakamoto wrote this:

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. - Satoshi Nakamoto

Trust.

Trust is the main problem.

What if we could solve the trust problem by solving the double spend problem?

“But Shadowy, I kind of like the government!”

OK, I'm happy for you! Just know that this stuff (inflation, huge crises and bailouts) will keep happening across the globe.

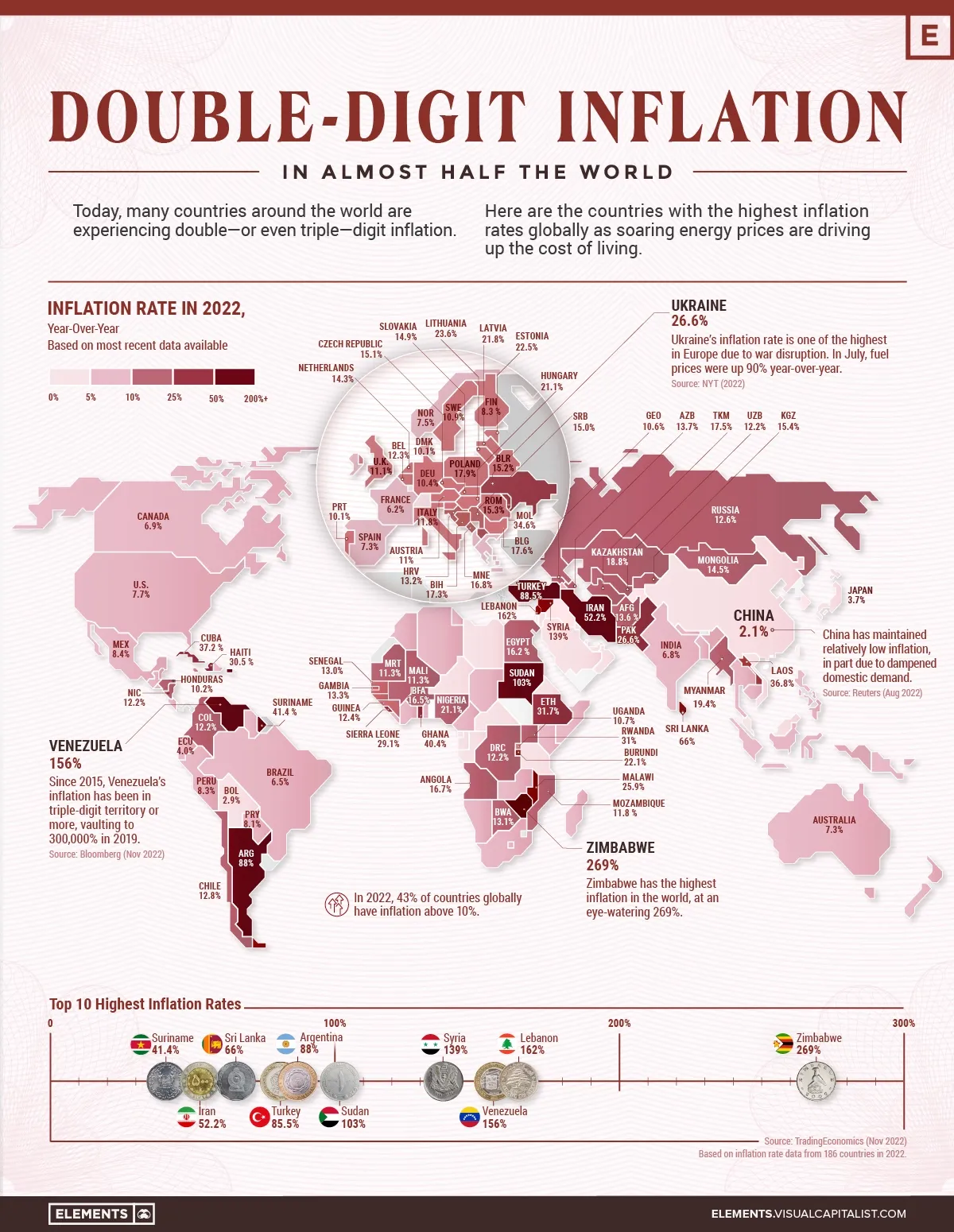

In Western countries people are generally less affected, but even here we have double-digit inflation at the moment:

We are seeing our net worth dwindle day by day. Lower and middle class are affected the most, with less money in stocks or real estate.

Besides, it's not because we have it good now that it will stay that way forever.

Fiat currencies have a history of collapsing due to corrupt or poor monetary policy and hyperinflation.The average lifespan of a fiat currency is only 35 years. These collapses occur more frequently than people realise. Here is a sampling:

Absolute power corrupts absolutely

However good our intentions are, after a while, we get corrupted a tiny bit. Mankind is fundamentally flawed. Give someone power, and after a while they will abuse it.

There is always some excuse to "relax" the rules. We as humans are subjective, we're rule benders by design. We look for the most efficient shortcuts.

If we elect people to have a lot of power, we are asking them to be objective and treat everyone fairly. We ask them to make the rules the same for everyone.

Unfortunately this is very hard to do, if not impossible.

The current system is what it is. Even if it was created with the best of intentions. The rules are not fair. They are not the same for everyone.

A lot of the money goes to the people closest to the printers. The game is rigged against you. The rich get richer in an unfair way.

Don't get me wrong. I love capitalism. I think it's the best system we have by far. Most of us lead absolutely crazy lives compared to a few hundred years ago. We live longer and have an abundance of options due to capitalism. Just look around you at all the different products and services you use on a daily basis. It's nothing short of amazing.

I am not against capitalism. I am against government corruption and favouritism. The playfield in which the game of capitalism is being played is crooked. The rules are unclear and unfair.

The state is not the good guy. Weird shit happens, everyone knows it but no-one can do anything about it.

Take Sam Bankman-Fried. He is treated by the press as if he's some poor whizzkid who made a dumb mistake, while Alexy Pertsev, one of the creators of Tornado cash went straight to jail for writing some code that enables freedom.

Life is unfair, what can you do 🤷♂️

Why fiat will keep failing

In any given system, energy has to be conserved for the system to continue existing. If there is a leak somewhere, then it will get abused until the system collapses.

In fiat regimes, the "admins" of the system will abuse their power to create money out of nowhere.

The "players" will find loopholes and try to cheat the system.

The "arena" will at some point cease to exist, either due to bankruptcy, intervention or collapse.

So far, Bitcoin is doing well. It has no admins, and – so far – no loopholes. There are no dependencies. No leader, no companies, no laws it has to follow.

As we can see today, many fiat regime "admins" are doing their best to sabotage their own power. They are killing the goose that lays the golden eggs.

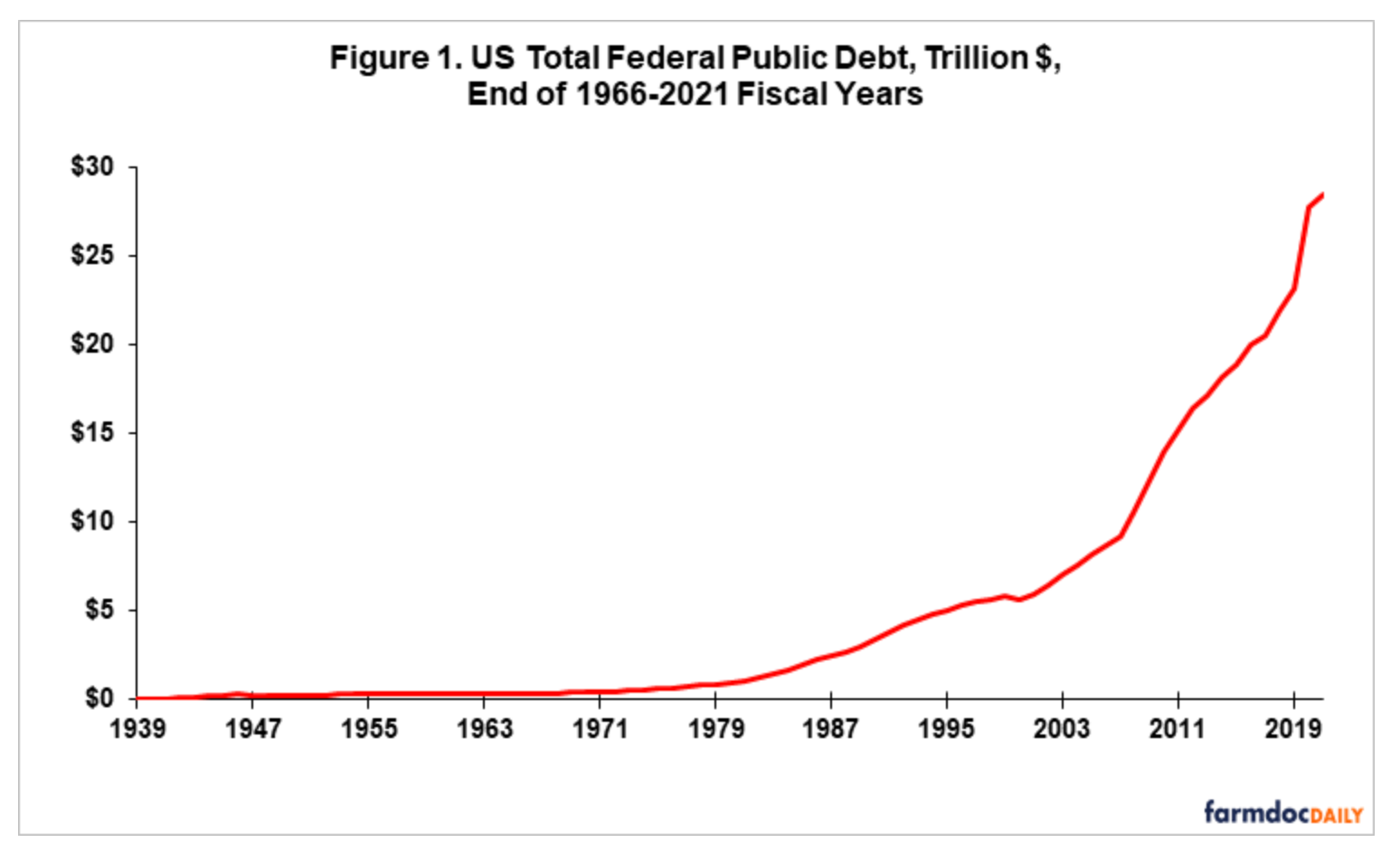

The US debt today is around 31 trillion dollars:

This is not sustainable in the long run.

The government is running after the facts

The government is pretty bad at managing monetary policy. It's a hard problem to solve.

So at this point you might ask yourself: why is it a good thing to further remove the central banks' ability to help the economy by introducing a fixed monetary policy?

Well this comes down to your viewpoint on economics.

I'm pretty sure that the mass manipulation of the economy by the government has mostly harmed us.

What's the government's plan when they see an impending recession? A shot of monetary espresso to jolt the market into action!

They think "These silly investors are way overreacting, don't they see that everything's fine? We'll just print some money!"

But investors and consumers are acting to market conditions as fast as market signals can travel. Central banks don't have magical powers to see the future of the markets faster than anyone else.

So when the central bank starts heating up the economy, it takes a while before it has any effect. They also don't know how long the recession would last. So they overshoot and heat up the economy too much.

They're essentially just trying out stuff blind.

They don't exactly know the effects of QE and money printing. They don't know how long it takes to heat up or cool down the economy. They don't know how long the recession would last without intervention. They don't know exactly how to measure the temperature of the economy.

And even without all of this, price signals take an incredibly long time to ripple through the economy, so they'd have to be able to predict the future to correctly compensate for the market conditions at any point in time.

They introduce a lot of uncertainty and more discontinuous changes, making everything harder to predict. Remember: unexpected things kill businesses, and especially startups.

And on top of that, they didn't even know the "ground truth" to begin with. What if the economy was cooling down for a reason. What if it was already way overheated and due for a small recession.

I can't imagine overstimulating the economy for years and years without any cooldown period is a good idea. This has been happening for the last 10 years or so and there's no way out without putting tons of people into default. It's a never-ending cycle of worsening unsustainable debt levels.

Manipulation by central banks is cargo cult behaviour. It doesn't shorten the recession but it prolongs the time the market is doing inefficient things. Not to mention the moral hazard and perverse incentives created by infinite money printing and handouts to your government buddies.

Intelligently allocating resources

People always say deflation is bad because people would just be "hoarding money" and not spending or investing it.

This is rather dumb.

Let's think about the stock market for a bit. Its purpose is resource allocation. We want to give the most money to the the startups and businesses that have the highest probability of creating a lot of value for society.

Inflation forces people to spend their money willy-nilly. Non-savvy, economically illiterate people are putting their life savings into the stock market because their cash is losing value day by day. They have to invest in riskier and riskier assets just to break even.

So let's say you have 10 billion dollars in "smart money". If you then add 10 billion dollars of "dumb" money, you water down the smart money.

Money is a zero-sum game. It's simply the denominator, a representation of all the value in the world. This means every extra dollar "waters down" all other dollars.

The dumb money is in effect a random allocation. The "smart money" is being diluted and becomes less effective.

This means less prosperity for everyone. Less technological breakthroughs, less innovation.

Money printing means more inflation, which means more degenerate gambling by the public. We've seen this in the last few years with meme stocks, Wallstreetbets, crypto investing, Web3, NFTs etc.

Nice little example of this climate:

Oh you know, just a bunch of billionaire capital allocators joking about pump dumping #Solana. Nah. pic.twitter.com/w0KCdOKnzw

— $goose (@GooseOfCrypto) November 3, 2021

And Sam-Bankman Frieds' infamous "It's just an empty box, it does literally nothing" interview:

Recessions are good

Recessions actually serve an important purpose. They get people to think about what they're spending their money on. They restructure the economy to make it more efficient. If we artificially prevent recessions from happening, a lot of bloat and inefficiencies build up in the system. Recessions are like the immune system clearing a cancerous growth.

Recessions are good, but we generally want people to be able to protect themselves against the effects of a recession if they've been diligent. We want to punish the bad actors and the people who take reckless risks. We do not want to punish the good family man investing his money in honest, low-risk stuff.

The problems start when we start incentivising and rewarding people for inefficient behaviour and bad decisions. Artificially prolonging growth by printing money does exactly that.

Inflation corrupts

If you're in the cookie making business, and you notice the government starts printing trillions of dollars out of nowhere, essentially doubling the money supply, what are you to do?

You have 3 options:

- Keep selling your cookies for $5

- Double the price of the cookies to $10

- Use cheaper ingredients that are less healthy or make your cookies smaller without anyone noticing

The only reasonable option is #3. If you choose option 1, you go bankrupt. If you choose option 2, your customers get angry and choose a different cookie supplier. You go bankrupt.

Inflation brings out the worst in people. They really have no other option than to provide worse services and products, because they need to do it to keep their businesses afloat in an inflationary environment. This is called shrinkflation.

If all prices and wages would rise simultaneously, there wouldn't be an issue. Everyone would see that money is just a representation of value and that everything stays the same. But that's not what happens. Central banks are deceiving the general public and making them poorer. The value goes to the people closest to the printers, which is called the Cantillon effect. This results in a moral bankrupt society where everyone has to lie and deceive to "break even".

Everything becomes shittier with inflation. Worse materials. Worse food. Worse quality.

Fiat housing is spending $3.5k/mo on a 1br "luxury" apartment that has doors made of cardboard and styrofoam. pic.twitter.com/6gL6zp2sCX

— Bitstein (@bitstein) November 7, 2022

Market incentives are enough

The idea behind Bitcoin is simple: we don't need the central bank for stability. Market incentives are enough for the economy to self correct. Price signals naturally flow through the economy and incentivise people to either start to produce more / consume less or to produce less / consume more. The prices should naturally reflect supply and demand.

Recessions will still naturally occur but they will be limited in scope and length.

The legacy system is broken, expensive and slow

The US institutions are outdated, using a 9-digit numbering system from 1936 to validate identities.

Unemployment Insurance is so broken that Congress found it easier to give everyone an extra $600 a week creating $150 billion in fraud, than to update the Cobol code it was written in.

We are spending $2 million on a single public toilet.

It takes 2 days to wire money. Final settlement takes ages. It's slow and manual and fails all the time.

Their massive overhead costs make micropayments impossible. - Satoshi Nakamoto

The government is run by technologically inept people. How do we expect them to keep up in an ever more technological society?

The rasoin d'être of Bitcoin is preventing government capture

All the other stuff about security and speed is completely irrelevant without decentralisation. Satoshi knew this.

The reason why Bitcoin is shit in some aspects is because it has to be decentralised. Many altcoin proponents do not get this. Their faster, cooler coins are irrelevant, simply because they are not decentralised.

Government overreach will keep happening because there is no other option for them. The only way to "fix" Bitcoin (as in make it go away), is for governments to pivot to a healthy, normal monetary policy, but that is simply very unlikely to happen.

Inalienable property rights

We want property that can't be arbitrarily devalued or captured.

No matter which way the Fed goes, the game theory calls for more capital moving into crypto. In this Lockdown Era of politicians perpetually moving the goalposts on your autonomy and economic sovereignty, Bitcoin is truly the only inalienable property right standing

We are seeing this now with CBDCs and the elimination of cash. This would mean that no two free men would be able to exchange money without intermediation by a bank.

If you believe that transacting freely is a human right, this should scare you.

Digital euro may have transaction limits and saving caps, ECB executive board member says

Bitcoin was invented, quite simply, to separate state and money.

I don't believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can't take them violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can't stop. – Hayek

Resources

https://dergigi.com/2022/10/02/bitcoin-is-digital-scarcity/

The Fiat Standard – Saifedean Ammous

The Big Short

https://www.secondbest.ca/p/before-the-flood

https://www.reddit.com/r/Bitcoin/comments/v0c5i0/when_is_inflation_a_good_thing/

https://www.reddit.com/r/Bitcoin/comments/uy60yi/comment/ia2x6sv/

https://bombthrower.com/all-fed-policy-tracks-still-lead-to-bitcoin/

If you liked this article, please follow me on Twitter or join my mailing list! Your support is the fuel to my writing fire 🔥 Thanks!