Deciphering Bitcoin – Part 1: The current system

Most articles about Bitcoin are garbage. I promise you, this one is not.

I'm going to explain the technical stuff in a way that even your grandma can understand. Plus, I'll debunk some common misconceptions and share my own "aha!" moments.

By the end of this series, you will have a deep understanding of the cultural, technical, political and economic aspects of Bitcoin.

Grab some popcorn and settle in.

Main outline:

Part 1: The current system

Part 2: Why was Bitcoin created

Part 3: The Bitcoin tech explained

Part 4: My conceptual breakthroughs

Part 5: The history of Bitcoin and crypto

Part 6: Threats to Bitcoin

Part 7: Practical information to get started

Please follow me on Twitter or subscribe to the mailing list below to be notified of the next part 🙏 Thank you!

The old school way

Money. The root of all evil, the cause of all our problems, and yet...we can't live without it. But have you ever stopped to think about how this mysterious substance came to be?

Back in the day, people traded goods and services like it was going out of style.

You had a cow, I had a chicken, let's make a deal. But then things got complicated. As societies grew and became more complex, trading became a nightmare.

How many chickens are worth a cow? And what if I don't want a chicken, but I really want that shiny rock over there? Yeah, it was a mess.

A new alternative

People used to keep around things like wheat, butter, tobacco, or salt. These items were useful and easy to divide up, so they became the go-to items for trading.

Over time, different commodities started competing to become the most popular form of money. Gold and silver emerged as the winners because they had the best properties - they were easy to store and transport, and they were durable and divisible.

Once a commodity is widely used, it gains strength through network effects.

People started pricing everything in terms of gold or silver, which made life a whole lot easier.

Imagine an economy with a thousand different items - you'd need a million different prices. Without a common currency, you'd need to price every item in terms of every other item. But with money, you only need a thousand prices.

Look at money as a unit of value, as a unit of purchasing power. We "pay" with goods and services to "buy" money. Just like the utility of wool is to keep you warm, the utility of money is to make trading easier.

With money, specialisation becomes possible, which means more different products are created. You can focus on making running shoes and I can focus on making formal shoes. Plus, people can invest in businesses and predict whether they'll make a profit.

But why do we accept money in the first place? Because it's the commodity with the widest price discovery against all other commodities. That's why everyone uses it, it's just so darn convenient!

The takeover

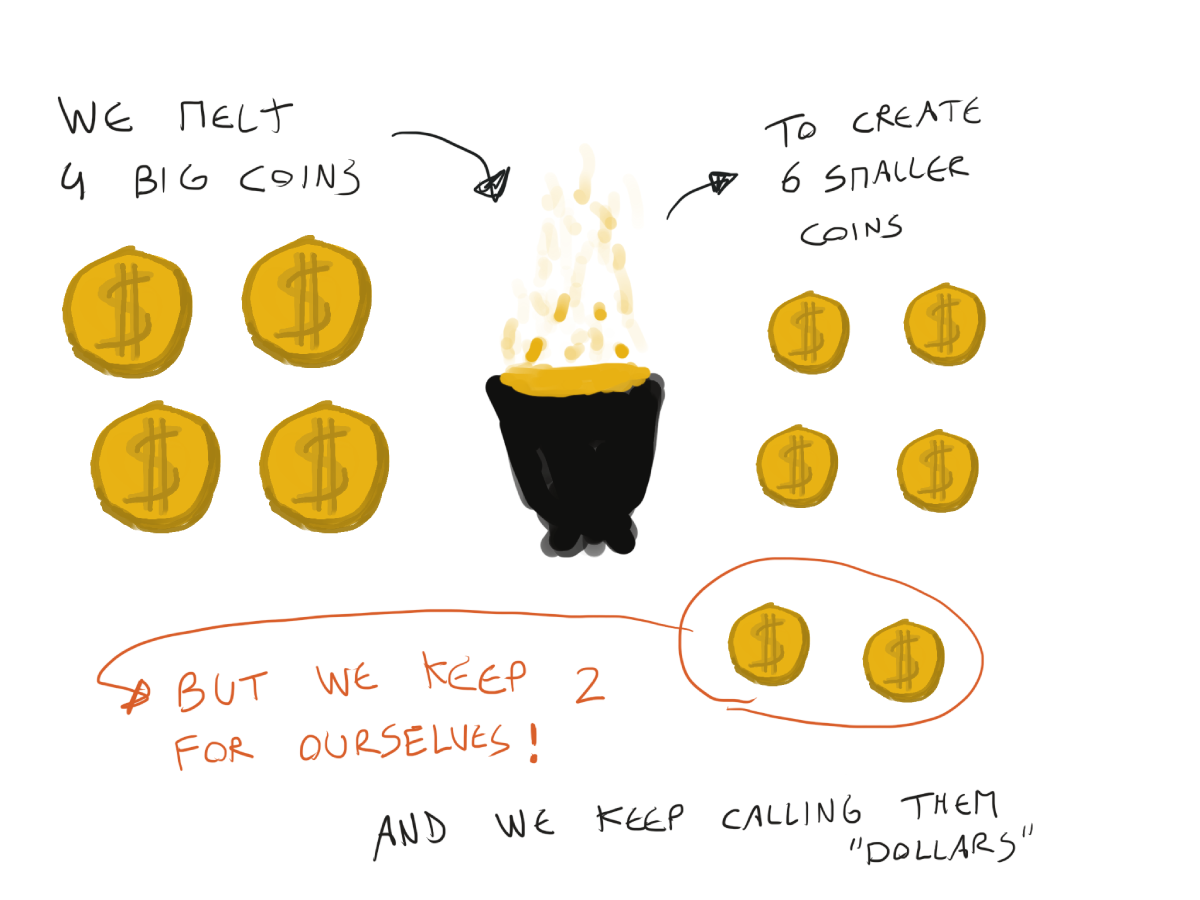

Welcome to the wild world of government theft, my friends. In the good old days, rulers would just take your money directly to fund their lavish lifestyles and armies. This is called taxation. But let's be real, that's a huge pain in the ass to organise.

So instead, they came up with this genius plan: give the gold coin a fancy name, like "dollar." Claim that it's supposed to weigh a certain amount.

But here's the real trick: melt down all the coins coming in as tax, make new ones that weigh slightly less, and keep calling them dollars. Voila! You're stealing from your peasants without them even realising it.

Talk about a useful abstraction...

This is called coin debasement.

Of course, eventually people catch on and prices start to rise because there's less gold in circulation. That's what we call inflation. And it's all thanks to the government's clever little scam.

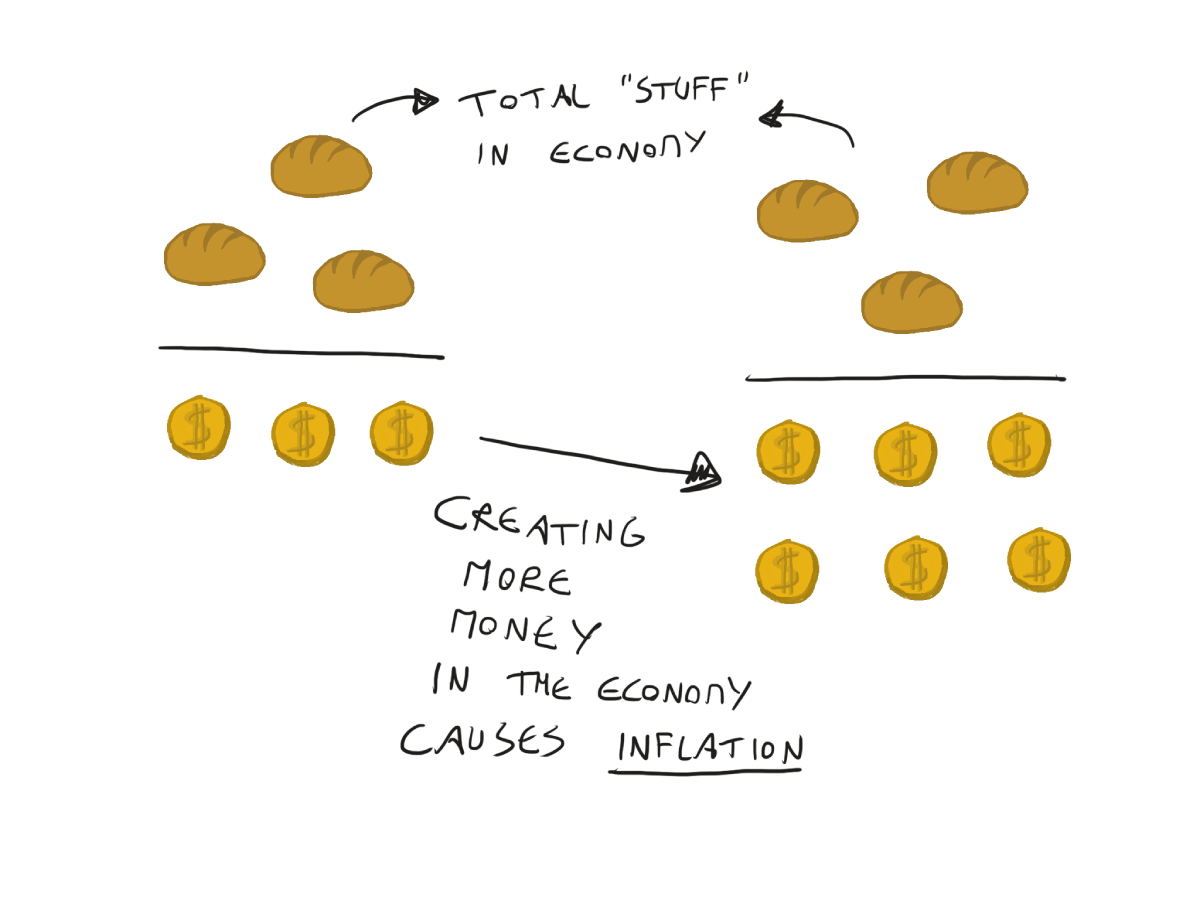

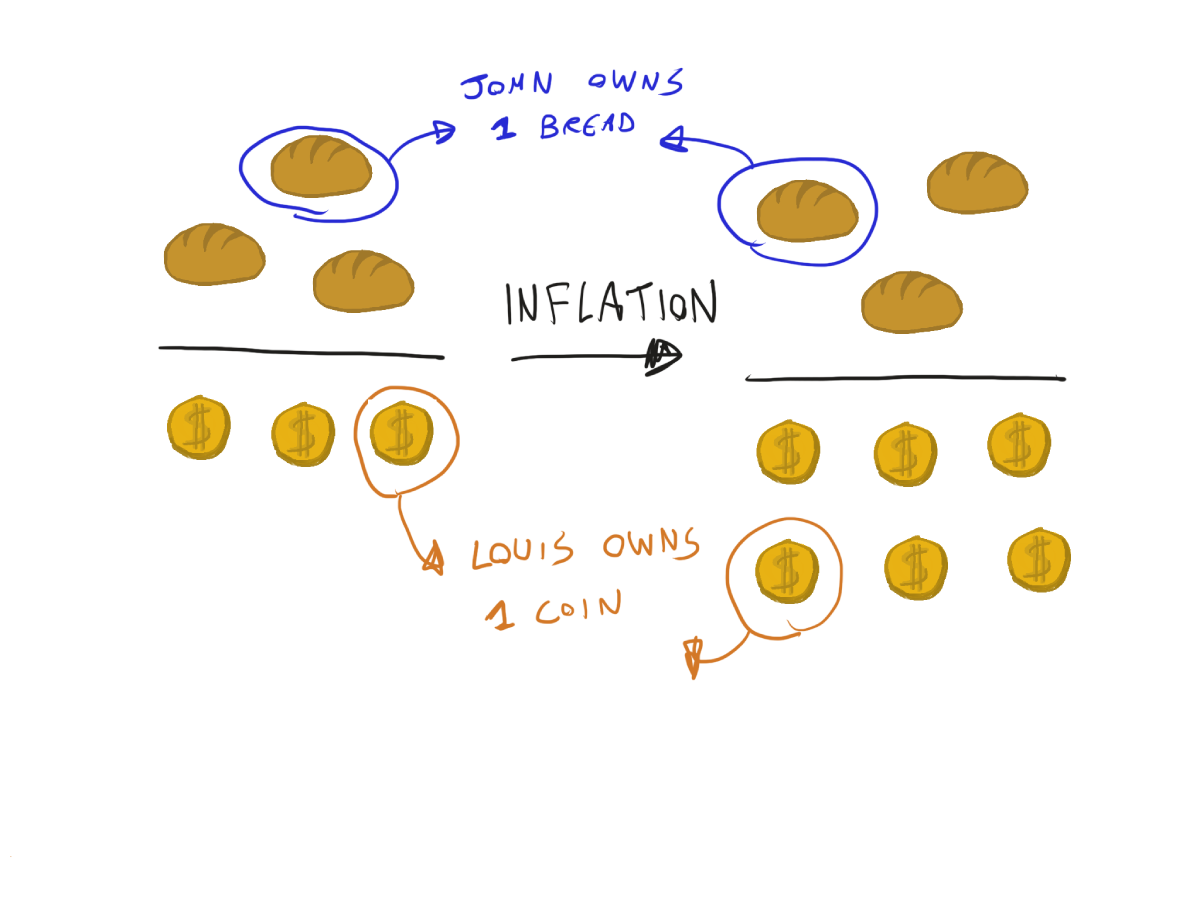

But how does inflation happen? In the example below, each bread starts out being worth 1 coin. After we create more coins and release them in the economy, people will intuitively start noticing that their money is worth less.

Remember that gold is just another commodity, like leather. If there's suddenly a huge increase in the amount of available leather, then the price of leather will decrease. This is simply supply and demand. In the same way, the "price" of gold will decrease if there's more of it, which means the price of all other stuff (priced in gold) will increase!

Gradually, prices of bread will increase to 2 coins per bread.

Let me tell you a little story about the perils of being an all-powerful ruler.

You see, when you declare that all dollars are worth the same, it sounds great on paper. But in reality, it's a nightmare. People start hoarding the "good" coins and only spending the lighter ones.

And as the coins get lighter and lighter, they become completely unusable.

Soon, all the good coins are hidden under the peasants' mattresses, or are being exported to other lands where they're worth way more.

So there is a physical limit on how light coins can get. At least this keeps inflation somewhat in check.

What is prosperity?

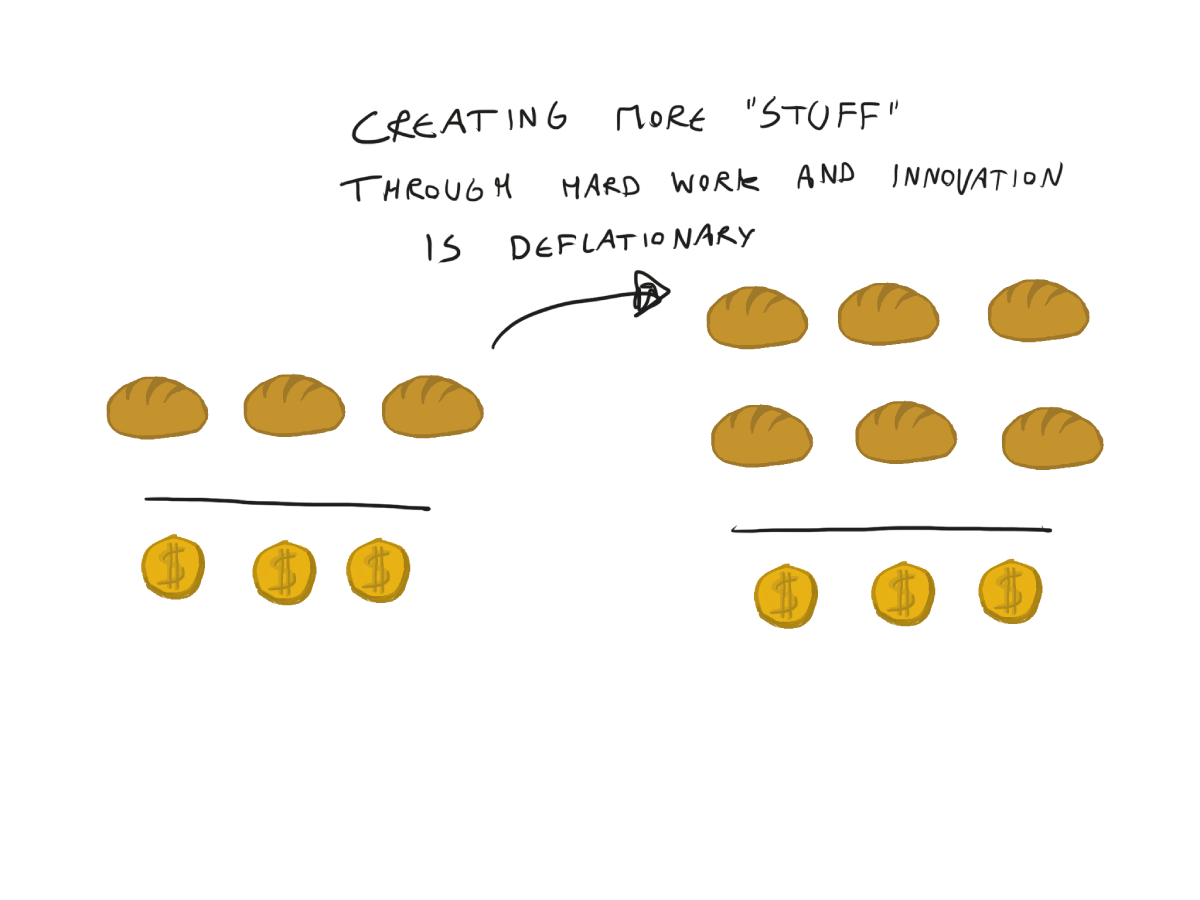

Prosperity is the stuff of legends. It's the magical land where bread is cheap and everyone is happy.

So how do we create prosperity? Does magically doubling the amount of money in the world make everyone happy? Unfortunately, no. That just means prices double and we're back to square one.

No, true prosperity comes from the magic of invention. When someone invents a machine that makes bread faster, we're all better off.

Creating value, creating more, better, faster. That's what truly matters.

Suddenly, bread is cheaper and we're living the good life. That's what we call deflation, and it's a beautiful thing.

However, not everyone believes deflation is a good thing. Some claim we are less willing to spend money in a deflationary environment, causing recessions. More about this later.

Discovering paper money

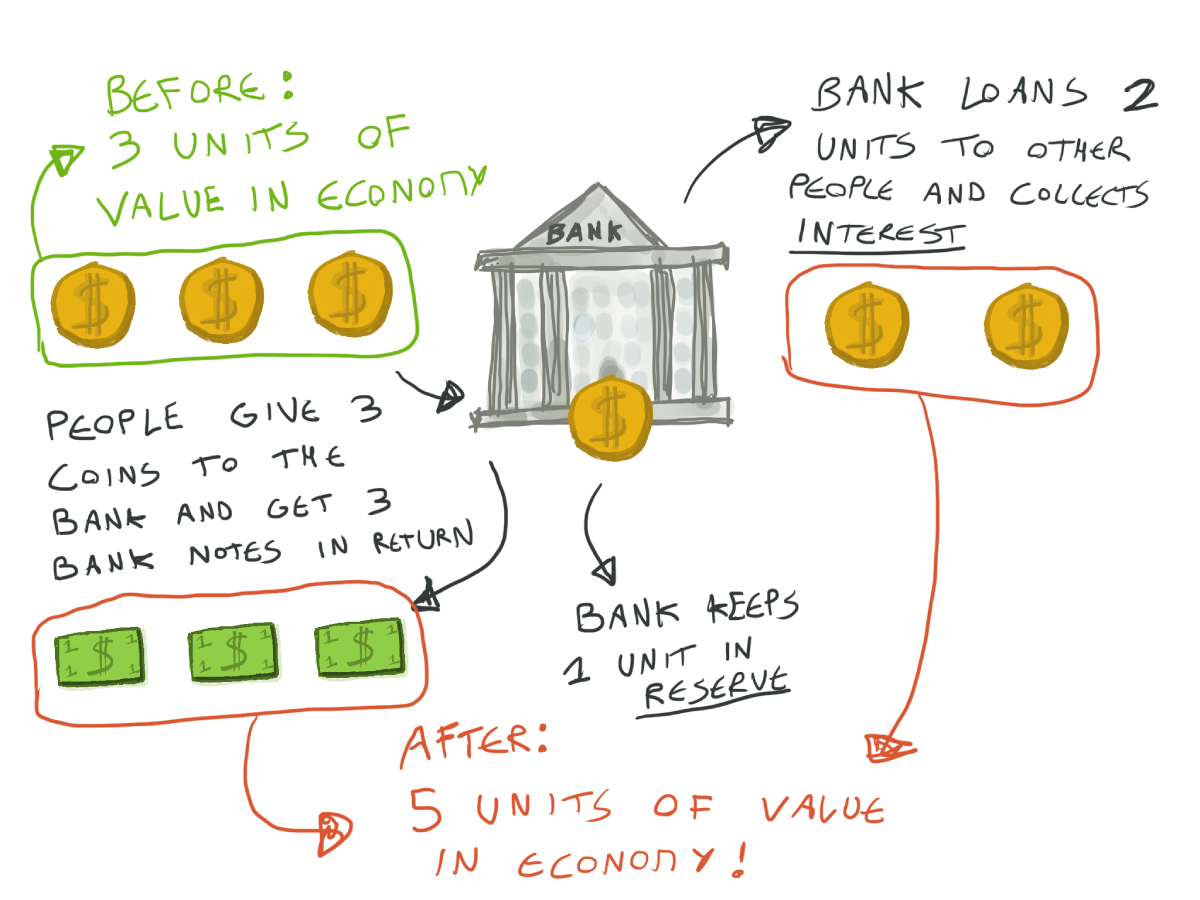

Once upon a time, peasants were loaded with gold coins and needed a safe place to stash them. Enter the bank.

In return for a fee, they offered to keep the peasants' coins safe and sound. But how did they keep track of how many coins each peasant had? And how could the peasants prove that it was really their money in the bank's safe?

Well, once the peasants handed over their coins to the bank, the bank gave them a receipt. This was called a bank note. The peasants could return the bank note to the bank at a later date and get their coins back.

But who wants to go to the bank every time they want to buy a loaf of bread? Not the peasants, that's for sure.

So instead, they just used the bank note to buy the bread, and the baker could redeem it for coins at a later date. And just like that, bank notes became a replacement for gold coins.

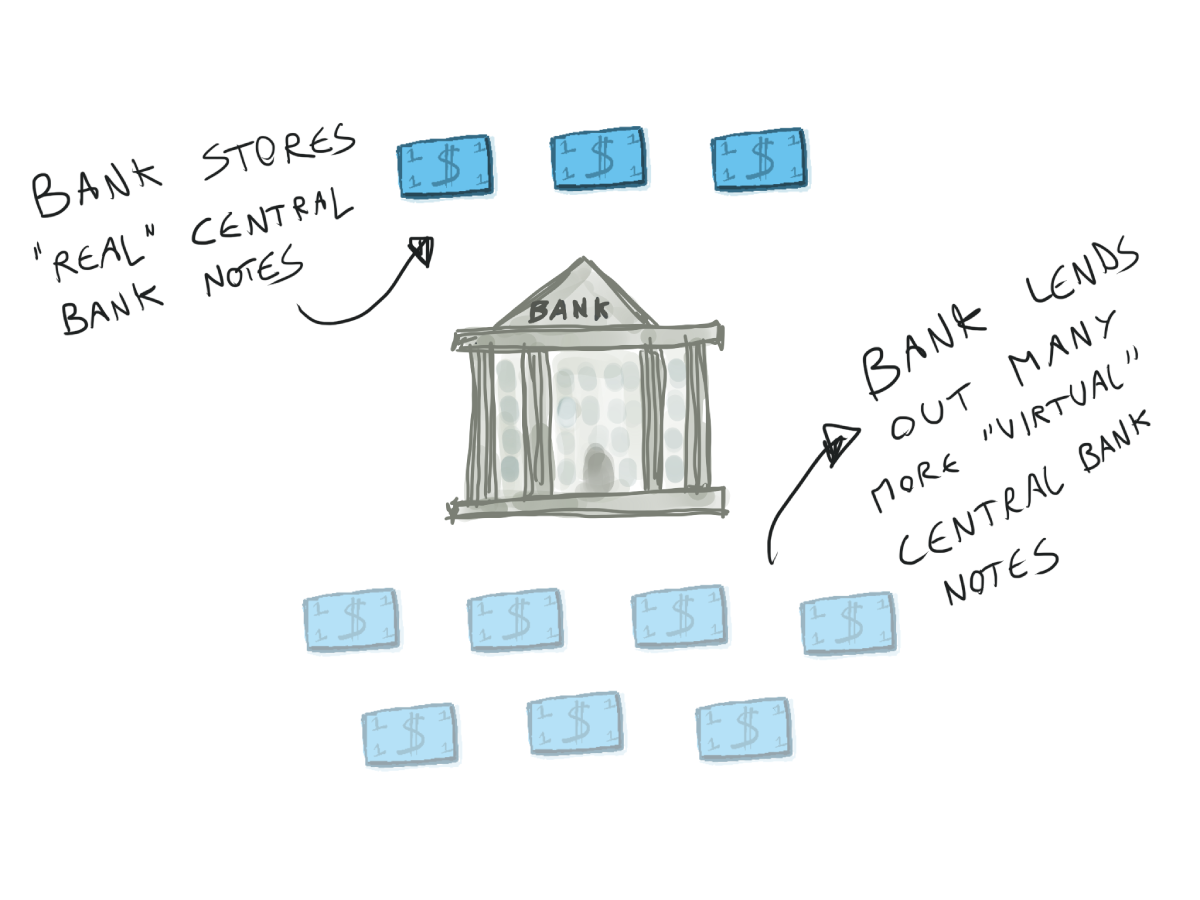

But the bankers, being the sly buggers that they are, realised that not everyone redeemed their coins at the same time. So they started printing more bank notes than they had coins in their safe. This is called fractional reserve banking.

It works like this:

But this trick of creating money out of thin air made all goods more expensive - hello again inflation!

Fortunately, the banks were somewhat limited in how much money they could conjure out of nowhere. If Alexa gave Brian a bank note from bank A, and Brian banks with bank B, then bank B would use the bank note from bank A to get the actual coin from the reserves of bank A. Bank B would then store the coin in their own reserves and give Brian a bank note from bank B.

This meant that banks had to have enough coins in their reserves to keep operations going between banks.

But sometimes the governments would get huge loans from the banks to finance wars. When the people realised this, they would all try to get their money out as soon as possible - a phenomenon known as a bank run. This could bankrupt the bank, because they obviously couldn't give everyone their money back!

To counter this, the government would declare bank holidays - days when no one was allowed to withdraw their money.

This set the stage for the biggest con of all...

“Nothing is so permanent as a temporary government program.” ― Milton Friedman

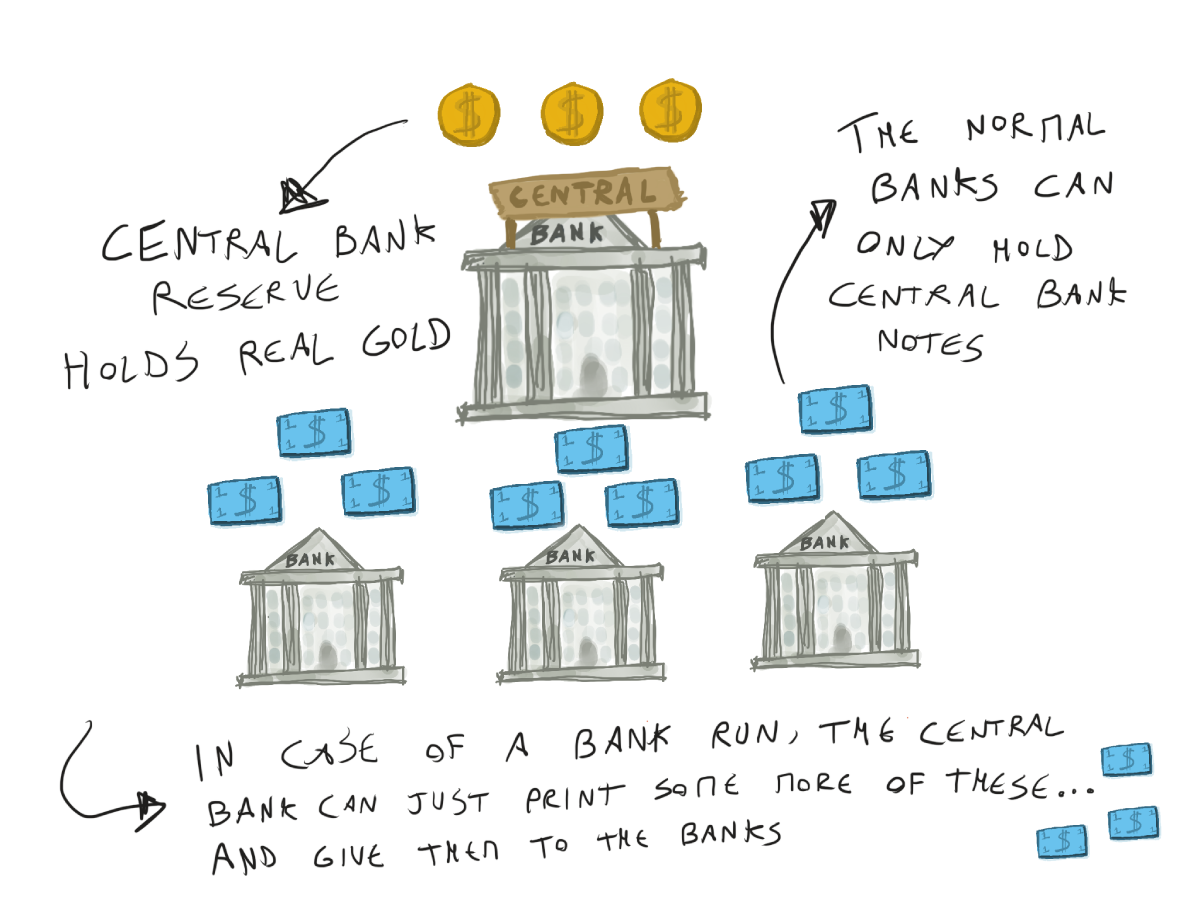

The creation of central banks

Imagine if the banks could create more gold coins out of thin air? It would prevent bank runs from ever happening again. If all the peasants came knocking on the bank's door at the same time, the bank could just conjure up some more coins and hand them out.

Well, there's actually a roundabout way to do this. We just create a central bank, which is the bank of all the other banks!

The next step is crucial: we tell the peasants and the "normal" banks that they should hand over all their gold, and we keep it safe in the vaults of the central bank. After all, what could be safer than storing your coins with the government?

But here's the catch - the normal banks are no longer allowed to store gold in their reserves. They can only store the substitute for gold that we just created: central bank notes.

Oh, and one more thing - the normal banks are OBLIGATED to bank with the central bank. They don't have a choice.

The normal banks hold "real" central bank notes in their reserves (which are not actually real because it's just paper money, it's not gold or silver) but can loan out "virtual" central bank notes to the people. This simply happens by updating a ledger (previously on paper, now digitally).

Welcome to the wild world of central banking, where the rules are made up and the money is printed on demand. It's a magical land where bank runs are a thing of the past.

“There is an infinite amount of cash in the Federal Reserve” - Neel Kashkari

How do they pull off this miraculous feat, you ask? Easy - if a bank ever gets in trouble because it doesn't have enough "real" central bank notes, it can just ask the central bank to print some more!

Note: It's important to realise that central banks do not literally "print" money in the way that we typically think of it, with sheets of paper and metal coins. Instead, they create new money virtually and buy government securities or make loans to commercial banks with it. It comes down to the same thing though.

But wait, there's a catch. The central bank doesn't actually have a reserve of gold to back up all that newly-minted cash. Instead, they rely on the good faith of the people to believe in the value of those pretty pieces of paper. No-one expects to get real gold or silver, even though at this point the notes are still "backed by" gold or silver.

As we can see now, both the central bank and the regular banks are fractional reserve banking!

And it worked like a charm. The people gladly traded in their hard-earned gold and silver for shiny new dollars, blissfully unaware that their purchasing power was slowly but surely being eroded away.

Today, a single dollar is worth a measly 0.046 ounces of silver (1.3 grams) - a far cry from its original value of one whole ounce (31 grams). So where did all that value go? Straight into the pockets of the government, of course. To its spending, its inefficiencies, and its cronies. The people got conned, plain and simple.

Just like Europeans once used their fancy glass-making skills to churn out fake money to enrich themselves in western Africa, central banks have the exclusive privilege of producing money at next to no cost.

The rich get richer

Imagine we print double the amount of money in circulation, and everyone can go to a bank and hand in their money and get double in return.

This would cause everything to become twice as expensive, but everyone is also twice as rich, so life goes on as usual. Nothing really changes.

Inflation would be less of a problem if prices would rise instantaneously with the amount of money in circulation.

Unfortunately that's not what happens in real life.

In the real world, the central bank loans the new money to big banks and financial institutions, who then use it to buy up assets before prices go up.

The money then slowly flows through the economy (for example through income and dividends) and prices of goods and assets rise.

By the time the rest of us see a dime of it, it's already too late. The prices have skyrocketed, and we're left holding the bag.

This is called the Cantillon effect. It's like a never-ending game of musical chairs, except the only people who ever get to sit down are the ones who already have a seat. The rest of us are left standing, watching our money dwindle away.

Assets

Unfortunately that's not the only reason the rich get richer.

In the above scenario, John is an asset owner. He's the proud owner of 1 bread. Louis is a saver. He keeps his money under his mattress. He owns 1 coin.

After inflation, on a surface level it seems like they both still own the same things and nothing's really changed.

Let's see if this checks out. John's bread is now worth 2 coins instead of 1, but coins are "worth less". Remember: money is just a way to measure value and to make trading easier. So John essentially owns the same amount of "value" as before. John still owns 1/6 of all the value in our little economy.

So far so good. But what happened with Louis? He has 1 coin, so the "nominal value" stays the same (1 coin is 1 coin), but "in real terms" he lost purchasing power. He can't afford one bread anymore, because it costs 2 coins. He effectively lost half of his wealth due to inflation. He used to own 1/6 of the economy, and now only owns 1/12. Poor Louis!

Rich people typically own assets like stocks, bonds or real estate. But the poor, they gotta hold onto the greenbacks, 'cause they either don't know any better or they just can't afford to get their hands on some assets. Have you seen the downpayment on a mortgage lately?

Debt

Debt sucks. It's like being stuck in a never-ending game of Monopoly where you keep landing on Boardwalk and Park Place and never seem to get a break. But not all debt is created equal, my friends.

Poor people tend to use debt for things like cars and phones, which lose value over time and don't really do anything for them in the long run. They also typically pay high interest rates out of ignorance, desperation, or simply because the banks trust them less to pay the money back so they ask for a premium.

But the rich, oh the rich. They use debt to create more value, like when they finance a new business or buy a bunch of real estate. They're playing a totally different game, one where they always land on the properties they want.

But let's go back to our little bread economy from above. Let's say Louis lends his coin to John before inflation hits. John owes Louis 1 coin, plus interest, let's say 1 extra coin over the course of a year (which is a pretty steep interest rate, but bear with me).

So, John has to pay Louis back 2 coins in a year. But then inflation happens and 3 new coins enter the economy.

Suddenly, John's debt to Louis is nominally the same (2 coins is still 2 coins), but the real value has gone down. John needs to pay back LESS in real terms. Now, instead of needing to pay back 1/3 of the value in the economy, John only has to pay 1/6.

Inflationary environments can actually be good if you're using debt for something productive.

It's starting to become clear why the rich benefit the most from inflation. They use a lot of debt to create value, and they own more assets and less cash than the poor.

The government and debt, a love story

Rich people may be raking in the dough, but the government is profiting too.

The government likes to spend money it doesn't have, and it'll do whatever it takes to keep the party going.

The central bank is their enabler, printing new money and loaning it to the government so they can continue to fund their inefficiencies and lavish subsidies on their favourite parties.

The government says "Sure, I'll pay you back, central bank!". But we all know how this story ends. Debt becomes cheap in inflationary environments, and the government can keep "borrowing" (aka printing money) forever.

Up until recently, there was still one thing keeping inflation in check: the gold standard. Each central bank note was worth a certain amount of gold or silver, and a dollar was an obligation of the central bank to pay someone a certain amount of silver.

This kept governments from printing too much money, because other countries could exchange the notes for real gold and silver, potentially bankrupting the country if they printed too much.

But governments wanted to have their cake and eat it too. They wanted to easily do international trade, and still be able to print more money.

The solution? Collude with all countries and abandon the gold standard altogether. It's like a group of teenagers who all agree to skip school, but then get caught and have to face the consequences.

Except in this case, the consequences are a potential global economic collapse.

The last straw

“The term fiat derives from the Latin word fiat, meaning "let it be done" used in the sense of an order, decree or resolution.”

Currency that's no longer backed by something "real" is called fiat currency. It does not have intrinsic value or utility. It only has value because some government says it does. Crazy, right?

But how did we end up in this situation? Well, let's take a trip down memory lane and find out. Buckle up, it's a wild ride.

The petrodollar

After WWII, a bunch of countries decided to keep their gold in the US because it was supposedly safer than in Europe.

World leaders were worried there would be another war unless they created a new economic system to avoid another Depression.

Since so much gold was already in the US, they made the US dollar the new standard with a peg to gold and other currencies. This is called the Bretton Woods system.

Other countries kept their reserves in US dollars, which the US promised to exchange for gold if they asked.

This system worked well until the sixties when the US created a ton of debt by printing dollars to finance the Vietnam war.

Other countries like France and the UK got scared they would get less gold for their dollars and decided to move their gold away from the US.

In 1971, Nixon decided you could no longer exchange dollars for gold. The US was the last country to get off the gold standard.

In 1973, the oil producing countries of OPEC decided to jack up the price of oil and embargo the US to punish them for their pro-Israel stance.

Nixon and Kissinger then made the "pact of the devil" with OPEC. With the largest military in the world, they had a lot of bargaining power and offered protection to OPEC in return for the pricing and payment of oil in US dollars. On top of that, OPEC countries promised to buy US debt (bonds) with their profits. This is called petrodollar recycling.

This way, OPEC countries finance the US. The US can keep creating debt out of nowhere and gets "real" dollars in return. They promise to pay off this debt later.

So the debt keeps going up. The US can keep funding wars and social programs.

The petrodollar recycling keeps US debt interest rates artificially low, which is great for the US because it means it can pay back its debt more easily.

Everyone wants dollars because they need it to buy oil. This means the dollar is very strong internationally.

This unnatural petrodollar recycling causes a runaway effect of more and more debt. The US continuously has to provide global liquidity in order to remain the world currency, and increasingly amasses larger deficits.

This is impossible to sustain in the long term...

International trade

Since the abandonment of the gold standard, it's all about the exchange rate between currencies, and how they're decided. Sometimes it's the free market, other times it's the central bank that decides.

But either way, these decisions have major geopolitical consequences. They can cause less efficient trade and even spark trade wars.

Take a simple example: the Chinese central bank sets an artificially low exchange rate from USD/CNY. Let's say you want a pair of headphones that cost 3 yuan. Normally, you'd get 3 yuan for a dollar. But if the Chinese central bank sets the exchange rate to 6 yuan for a dollar, suddenly you can buy 2 headphones for a dollar instead of just one.

This makes Chinese exports cheaper and more attractive to other countries, which stimulates the Chinese economy.

"Hey world, come and get our cheap headphones!" While it might be good for their economy, it can cause some major headaches for other countries.

How does the government control inflation?

The government has to make sure inflation doesn't get too much out of hand. If it does, nasty things start to happen. People lose their purchasing power and start to revolt. This is called hyperinflation, and it's very bad.

It's now clear that governments can influence how much inflation there is in the economy.

To pull this off, they have a few tricks up their sleeve:

1) Set the reserve requirements of the banks

This means they can say how many central bank notes the banks need to keep in their reserves.

For example if the banks need to keep 10 "real" notes in their reserves for every 100 "virtual" notes they give out in loans, this means the money multiplier is 10.

If they then say banks need to keep only 5 "real" notes in their reserves for every 100 "virtual" notes, then the banks can suddenly lend out twice as much money, which means inflation will rise.

However, since March 2020, the reserve requirements were dropped to zero!

2) Change the interest rates

They can indirectly set interest rates (we won't go into how they do this).

The higher the rates, the less banks and people will want to get a loan (because they'd have to pay back more money in the future).

- This means less loans are being made and thus less money is being created out of nowhere (remember: loans are typically made with "virtual" central bank notes that don't actually exist, it's simply a ledger being updated).

- People will also invest and spend less which causes prices to go down.

Both of these things lower inflation.

3) Open market operations

The government can decide to directly buy or sell debt (called Treasuries) in the open market.

If they want to expand the money supply and increase inflation, they will buy Treasuries from the banks with new money. This incentivises the banks to lend out this money to consumers. As the banks compete with each other to give new loans, the interest rates will decrease and everyone will be able to borrow more and spend more. The economy "grows".

If they want to contract the money supply and decrease inflation, they will sell Treasuries to the banks, and destroy the money coming in. The money supply contracts, interest rates go up (because banks become less keen to loan money) and economic activity slows down.

Is inflation really necessary?

The government typically wants some inflation, maybe 2%. This is in line with the population growth rate and the produce growth target, which means prices would roughly remain stable around this inflation rate.

They claim a little bit of inflation is good for the economy, like a splash of hot sauce on your burrito. It makes things spicy.

They say it promotes the "growth of the economy". The theory goes if your money loses its value continuously, you're going to want to spend it. People will want to consume more. Businesses get incentivised to invest in R&D and new machinery, or to loan out money to other businesses.

At least, that's the mainstream line of thinking. In the next part we will explore this concept a bit more and explain why this doesn't really make sense.

A more likely reason the government wants some inflation is because it gives them more manoeuvring room in a downturn. If the interest rate is already near zero, they can't decrease it much further to try to kickstart the economy.

The government, the puppet masters of our lives

As we found out, the government has to walk a tightrope of inflation and interest rates.

Too much interest, and the party is over. The music stops, the lights come on, and everyone goes home. That's a recession.

But let the good times roll too much and soon enough, the wealthy elite are swimming in free money like Scrooge McDuck. And while at first it seems great, with stocks going up and everyone getting rich, eventually it all has to come crashing down in a burning pile of worthless cash. This is (hyper)inflation.

The prevailing theory is that the government has it all figured out and does what's best for the people. But let's be real, they're just winging it.

The economy is too complex and dynamic to be steered like a ship. It consists of 8 billion collective, interconnected minds, making it a highly chaotic and unpredictable system.

Sometimes, it's best to let the free market do its thing.

“I think we now understand better how little we understand about inflation” - Jerome Powell

Quantitative easing

You know what they say: when you're on the brink of a recession and all else fails, just do some quantitative easing! It's the monetary policy move of the century.

But what is quantitative easing, you ask? Well, it's the fancy way of saying "let's print a whole bunch of money and use it to buy up some assets." The government does this when regular ol' interest rate cuts just aren't cutting it anymore (for example when interest is already near zero). It's a sign that things are getting real.

But here's the thing: when the Fed does quantitative easing, they're not just buying any old asset. Oh no, they're buying the riskiest, most long-term assets they can find. And they're not just doing it to screw with interest rates either. No, the goal of quantitative easing is to inject liquidity into the economy and "save" certain sectors that are on the brink.

In short, quantitative easing is the ultimate desperation move. But hey, when you're in a tight spot, sometimes you gotta do what you gotta do.

Soft landings

Soft landings are the government's way of pretending they're not about to crash and burn the economy like a cheap carnival ride.

They know they've been artificially pumping up the economy, but they're trying to "slowly let us down", trying to convince us that it's all under control.

But you can't escape reality indefinitely. You can choose between being punched in the face or kicked in the nuts - either way, it's gonna hurt. Hyperinflation or recession, take your pick. Or maybe even both...

“If the central banks plan, no-one else can plan” – Hayek

CBDCs

Please welcome Central Bank Digital Currencies!

Remember the Soviet Union's GOs bank? You know, the one where if you said something "wrong," your money got terminated? It's that, on steroids. Yikes. And now they want to combine that kind of power with digital technology.

Governments could then control your money with the snap of their fingers. No more lending, no more credit - just straight up creation of money out of thin air. It's truly "fiat" in that sense.

At least the credit creation was self correcting. If they allowed too much credit, this created a bubble which collapsed at some point. No longer the case with CBDCs.

So the problem with CBDCs is the potential for much faster inflation, and the enormous amount of power it gives to governments. Imagine a world where your money is just a number on your phone and any activity you do is monitored and controlled through your spending.

And if the government wants to introduce a new lockdown? They can just make your money not work. Suddenly, your money is broken and you can only spend it in your local supermarket for the next three months because you're not allowed to leave your neighbourhood.

Talk about a dystopian nightmare.

So where does that leave us?

Obviously it's not all bad. Lots of prosperity has been created in the last 70 years. Some parts of the system are working just fine. People are generally better off than in any other time in history. Some governments obviously do a lot of good things.

Still, it's not all sunshine and rainbows. The mainstream view is that the government is efficient and is, by default, the "good guy". As we will see in the next part of this series, this is not always the case.

On top of that, we are now on the brink of the era of CBDCs. The world is becoming too complex for us to grasp. Everything is moving incredibly quickly. There's a lot of misinformation through increasingly powerful AI and algorithmic information feeds. The world is about to get real weird, real fast.

Fun times, right?

In the middle of all this, there is a small seed that's growing. A small idea that is slowly changing the world...

“Nothing else in the world…not all the armies…is so powerful as an idea whose time has come.” – Victor Hugo

In the next part I will talk about why Bitcoin was invented. Here's a little teaser:

#Bitcoin or bust.pic.twitter.com/994qx9HKSO

— Gigi ⚡🧡 (@dergigi) December 3, 2022

“They own everything…They don’t care about you…They got you by the balls.”

— James Melville (@JamesMelville) December 4, 2022

~ George Carlin

He absolutely nailed it. This is one of the greatest social and political commentaries of the modern era. pic.twitter.com/m565p03YnF

Please follow me on Twitter or subscribe to the mailing list below. This gives me the motivation to keep writing 🙏 Thank you!

Resources

https://twitter.com/paraschopra/status/1346688696599252993?lang=en

https://breedlove22.medium.com/masters-and-slaves-of-money-255ecc93404f

https://bitcoinmagazine.com/culture/the-hidden-costs-of-the-petrodollar